Living Benefits Protect Your Finances while You’re Alive

FEGLI only pays if you die

A Living Benefit policy lets you access part of your death benefit while alive if you experience a critical illness (heart attack, cancer, stroke), a chronic illness (can’t perform 2+ daily living activities), or needing care or treatment for a terminal illness

This means you could

Pay medical bills or replace income during illness, avoid dipping into retirement funds or going into debt, and you could choose to remain financially independent during a health crises.

FEGLI provides zero coverage for these situations — meaning you’d have to pay out-of-pocket or buy separate long-term care coverage.

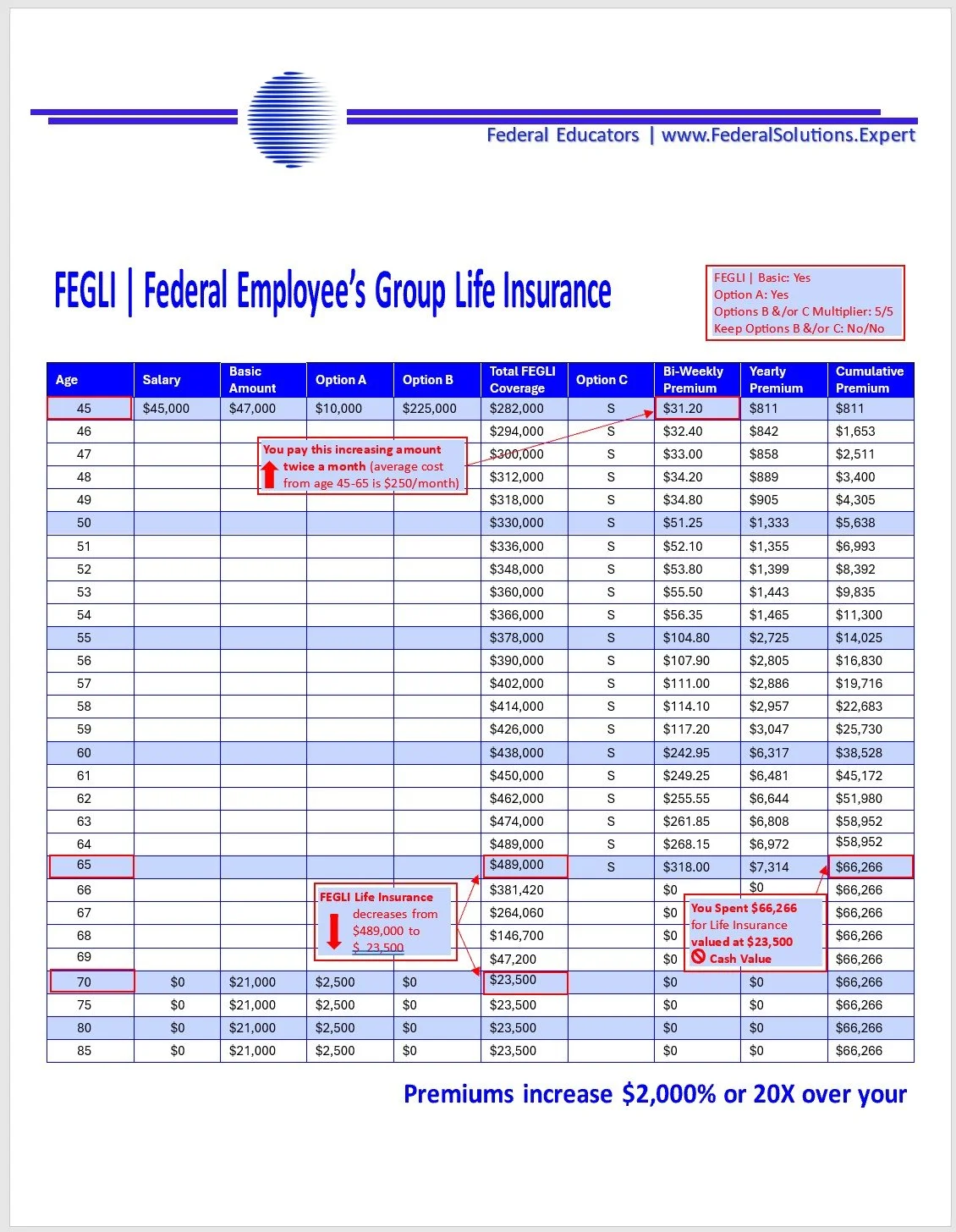

FEGLI coverage reduces or terminates at retirement (usually dropping by 75% or becoming unaffordable).

Living Benefit insurance stays with you for life, regardless of your job or retirement status.

You won’t need to requalify for a new policy later in life (when health risks make it more expensive).

Additional Tax Advantages

Your plan can accumulate cash value that grows tax-deferred.

Additionally, the death benefit is income tax-free to your beneficiaries.

And, you have access to cash via loans (which are tax-free, if structured properly).

This provides additional retirement and estate planning advantages that FEGLI cannot offer.

A Living Benefit policy functions as both protection and an asset. Instead of just paying premiums for a death benefit, your money:

Builds value,

Protects you while alive, and

Secures your family’s future with stable, lifelong coverage.

In contrast, FEGLI becomes a rising expense that provides no return and no benefits while you’re alive.